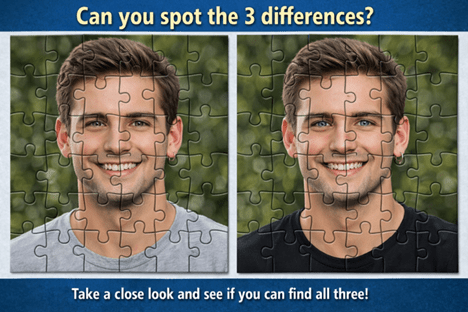

How’s It Like the Game – Can you spot the differences?

But Founders don’t have time for games. They want solutions – not titles. The real question isn’t whether you need a CFO or a Controller. The question is: do you have a foundation that lets you make confident decisions and grow value?

1: The Questions That Keep Founders Up at Night

Before debating titles, ask the questions that really matter. A small sampling:

- What’s my largest expense, and is it delivering real value? Payroll? Inventory?

- Are my Services more profitable sold as Product?

- How much time do I spend making sure my numbers are accurate and are they market-competitive?

- If I move from in-house servers to the cloud, does that change my EBITDA?

- Will a valuation firm need more than a couple of years of high-level financials?

- If my numbers are audited, will that improve my multiple?

- Why is my cash flow not keeping up with sales?

- Is it cheaper to expand shipping or open another satellite location?

- Can I improve SaaS revenue by taking more upfront payments. Will that shift affect P&L and cash flow?

- Is QuickBooks still enough for my size?

- Can I clean out fifteen years of payroll and tax boxes in storage?

Each question points to a gap in foundation, irrespective of the title or level of the one who answers.

2: Real-Life Founder Experiences

Here’s why this matters and why I emphasize fit over title:

At a software SaaS startup, the founders were an excellent team. One was the technical developer, the other the “suit,” brilliant at selling and presenting to the industry. But the missing ingredient was a scalable accounting system maintained by a bookkeeper. When the company expanded to an offshore development center, QuickBooks couldn’t handle multicurrency consolidation. Have you ever tried multicurrency consolidation in QuickBooks? It’s painful and not recommended.

In another founder-led service business, there were no currency complications, but other hidden gaps. ADP processing costs were creeping up. Spreadsheets were used to analyze pay and rate trends by location, level, client, and service stream. Actually, it was more like Excel as a chalkboard. The founder was, generously speaking, lightly familiar with Excel. He spent hours every two weeks updating a mammoth file with little actual reporting.

More important in the latter case, the founders had developed a piece of software for the business that was at least five years ahead of competitor technology. It was described as a cost saving tool. Flip the narrative and it became the innovative competitive advantage boosting the firm’s valuation multiple. It was a question no one was even asking. Do you think they cared if the valuation boost originated with a CFO versus a Controller?

In both cases, when the founders originally wanted to test the market, the tools used were inadequate. But the “Hands-on CFO,” “CFO,” “Controller” made sure we were comfortably off the inadequate tools, ready for crunch time. We had ready, comprehensive historicals going back five years, audited results a buyer could rely on, valuation narrative and more.

Deliverables? Processes ran smoother, diligence was seamless, and the consistent, reliable records supported premium multiples, but economically at “Controller-level” cost.

3: Why the Name on the Door Doesn’t Matter

You don’t care if the person helping you is called a CFO or Controller. Not really sure if you can identify all the differences anyway. What matters is:

- Someone who can step in and secure your foundation.

- You need a partner who will solve the problem and stick around to ensure the solution works.

- Credentials like a CPA or MBA are table stakes. But the real value is problem-solving ability and accountability.

You don’t want a one-time consultant who disappears after payday. You want someone who acts like a dedicated employee, invested in your business’s long-term health.

4: Building the Foundation Before the Title

Once the foundation is secure, the right title often becomes obvious. But until then:

- Organize your financial records.

- Understand your expenses and margins.

- Ensure cash flow aligns with sales and operations.

- Put systems in place that produce accurate, reliable numbers.

These foundational issues matter – a lot.

Find someone to secure the foundation. No games. Fit matters more than the title.

In the spirit of blogging – no sales here. If you have a question or are facing a challenge, feel free to reach out. Exchanging ideas is cost-free, and the benefits usually go both ways.

Leave a comment